Preparing to Receive Payments

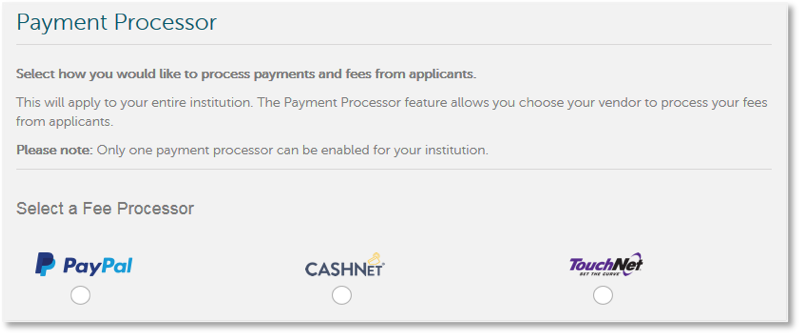

If you activated the Fee Collection or Supplemental Application activities in the Applicant Gateway Editor, applicants can submit payments to your program through the Applicant Gateway. The Applicant Gateway allows organizations to use PayPal, CashNet, or TouchNet as their payment service. This configuration must be completed to receive payments.

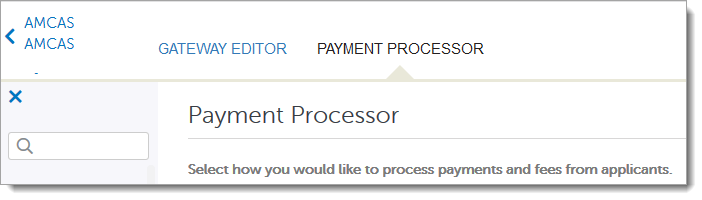

Click the Payment Processor Selection icon on the Applicant Gateway Editor page.

Next, select your desired Payment Processor.

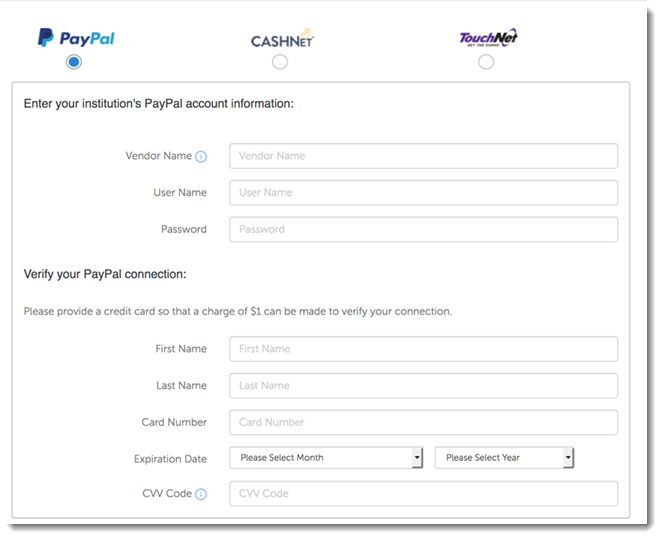

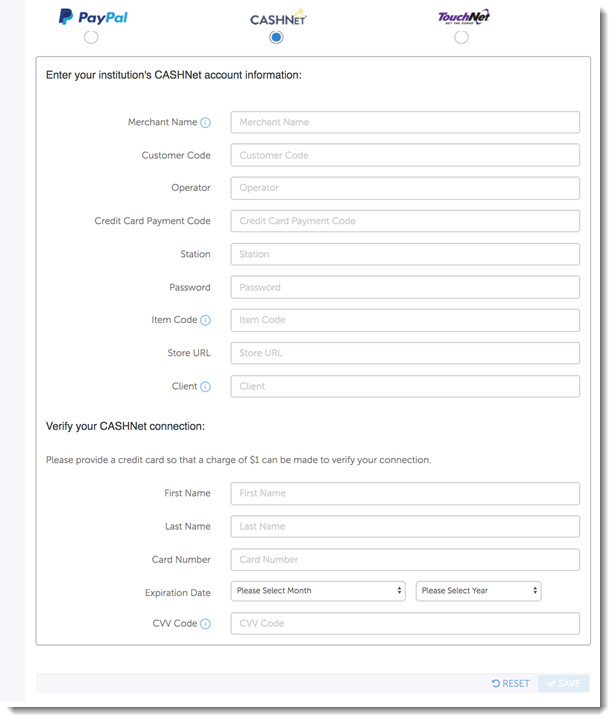

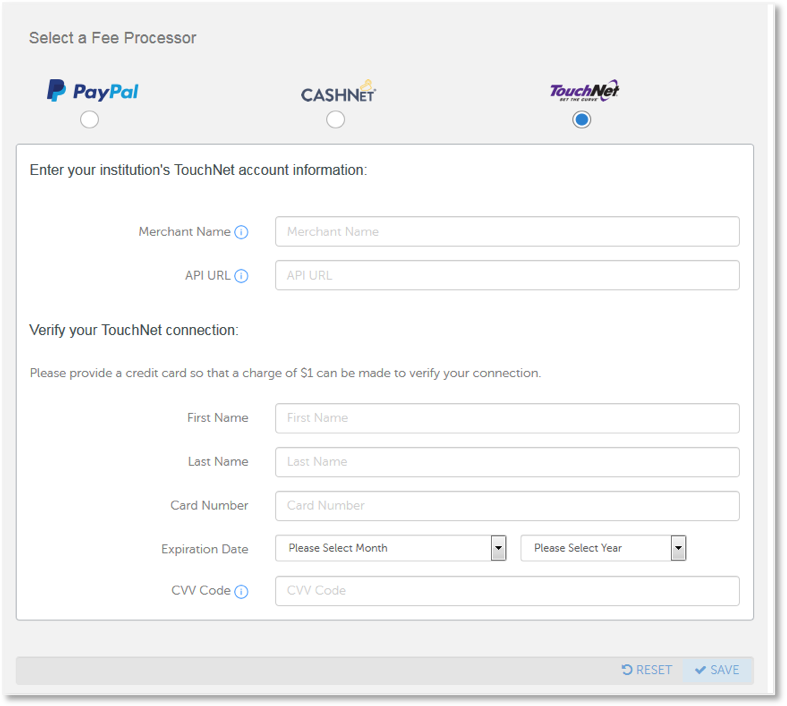

Enter your account information for the selected processor.

PayPal Example

CashNet Example

TouchNet Example

Contact your vendor for assistance with what parameters to enter.

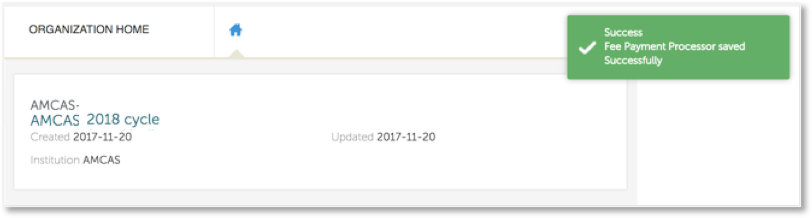

Once you’ve completed the form, a success message appears.

To verify a functioning connection, a $1.00 charge will be made to your account.

Payment Vendors

PayPal

Liaison is pleased to coordinate the following PayPal onboarding process for our clients. To get started, request that Liaison schedule an introductory phone call between your team and PayPal. During this call, the PayPal team will explain the features and benefits of PayPal Payflow Pro credit card processing. If you're interested in implementing PayPal Pro, provide Liaison with the following information:

- Annual Visa, MasterCard, American Express, and Discover card transaction volume

- Average ticket value and total annual processing value

- Description of the product or service sold and the buyers (i.e., consumers, B2B, domestic, international)

- 2-3 months of credit card processing statements (during peak processing months) from your current processor

- Any gateway, statement, chargeback, or other fees

PayPal will then create and present a credit card processing proposal that includes:

- A description of the PayPal services to be provided

- PayPal processing rates for Visa, MasterCard, American Express, and Discover

- A comparison of the effective rate of PayPal versus the current processor

If you accept the proposal, PayPal will arrange a call with a client administrator and the PayPal account manager to set up your account. The request is then submitted to PayPal's underwriting team who may request recent annual financials, including your Income Statement, Cashflow Statement, Balance Sheet, and recent bank statements that show cash balance, to better understand your business and financials.

Once the underwriting team approves the account, it will be activated and available for testing. We recommend that you develop a plan to test a variety of use cases. Once testing is complete, the account is ready to launch. We recommend launching early in the week and not on a Friday. PayPal's support team will be available to help during the testing and launch process. Upon launch, a dedicated PayPal team will be available for ongoing service and support.

CashNet

For more information on CashNet, please refer to the information below.

Jim Majka, Business Development and Partnerships

james.majka@blackboard.com

TouchNet

For more information on TouchNet, please refer to the information below.

Emily Fitts, TouchNet Ready

TouchNetReady@touchnet.com

(913)-599-6699 (office)

15520 College Blvd

Lenexa, KS 66219

Enabling Fee Collection in WebAdMIT

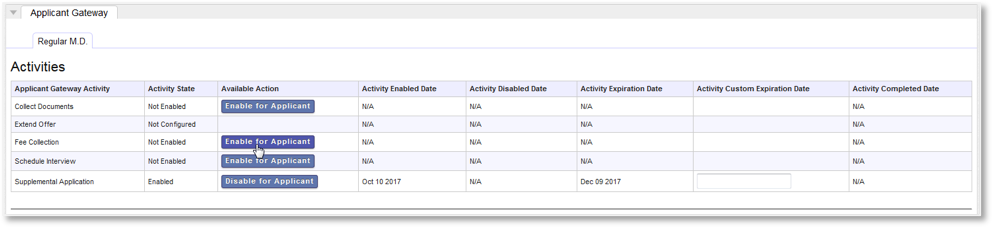

Once the Fee Collection activity is activated, Fee Collection appears as an option to enable in the WebAdMIT Applicant Gateway panel for applicable applicants.

On an Applicant Details page, scroll down to the appropriate Activities subpanel and click Enable for Applicant on the Fee Collection line.

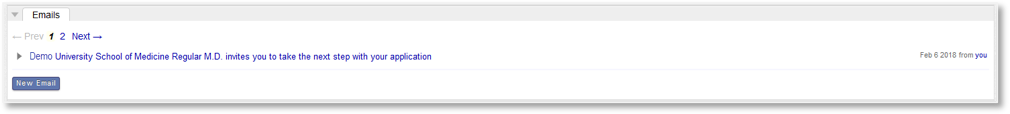

This action sends an email to the applicant, inviting them to complete this activity. To see emails that were sent, view the Emails panel.