Fee Collection, Reconciliation, and Remittance: GradCAS

Setting Up Fee Collection

Application Processing Fee (i.e., GradCAS Fee Collected by Liaison)

GradCAS charges a $38 processing fee for each designation (i.e., program) an applicant applies to. This fee is collected before the applicant submits their application to your program and is retained by Liaison.

Program Fee (i.e., School Fee)

While the application processing fee is retained by Liaison, a program can choose to collect a program fee. This fee is configured in the CAS Configuration Portal on the Program Details page. Once the program fee is configured, it's collected by Liaison before the applicant submits their application to your program, then distributed back to your school on a quarterly basis (less any applicable credit card and bank fees). See the Reporting, Reconciliation, and Remittance section below for more information.

Configuring Fees

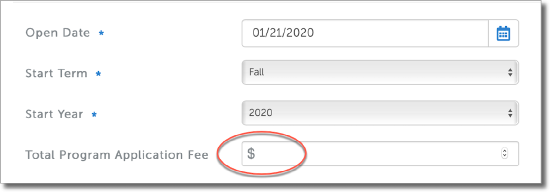

When configuring your Program Details, use the Total Program Application Fee box to enter the total fee amount the student needs to pay (including the application processing fee due to Liaison) before they submit their application to your program:

The amount you enter in the Total Program Application Fee box will depend on the fee configuration option you choose, as outlined below. If you have questions during this process or are not sure which option to select, contact a member of your account team.

|

Fee Configuration Options |

When do I select this option? |

What amount do I list in the Total Program Application Fee box? |

Reconciliation & Remittance |

|---|---|---|---|

|

Option 1: |

Choose this option if you want to collect a program fee via the CAS application. With this option, the applicant is responsible for paying both the application processing fee and the program fee. |

Assume the application processing fee is $25 and the program fee is $40. The Total Program Application Fee box should list $65.00. |

As applicants submit their applications, Liaison collects both the application processing fee and the program fee. Program fees less bank processing fees are remitted to the school on a quarterly basis. |

|

Option 2: |

Choose this option if you do not want to collect a program fee via the CAS application. With this option, the applicant is responsible for paying the application processing fee. |

Assume the application processing fee is $25 and the program fee is $0. The Total Program Application Fee box should list $25.00. |

As applicants submit their applications, Liaison collects the application processing fee. Note: Liaison does not provide a quarterly report with program fee remittance. |

|

Option 3: |

Choose this option if you want to collect a program fee from the applicant but do not want them to pay the application processing fee. With this option, the applicant is responsible for paying the program fee only. Additionally, your school is responsible for remitting payment to Liaison for the application processing fee for all applicants who apply to the program.

|

Assume the application processing fee is $25 and the program fee is $40. The Total Program Application Fee box should list $40.00. |

As applicants submit their applications, Liaison collects the program fee. On a quarterly basis, Liaison tallies the number of applications submitted, deducts the total amount of application processing fees and bank processing fees from the collected program fees, and remits the remaining amount to the school. |

|

Option 4: |

Choose this option if you do not want to collect a program fee and do not want applicants to pay the application processing fee. With this option, your school is responsible for remitting payment to Liaison for the application processing fee for all applicants who apply to the program. |

Assume the application processing fee is $25 and the program fee is $0. The Total Program Application Fee box should list $0.00.

|

As applicants submit their applications, no fees are collected. On a quarterly basis, Liaison tallies the number of applications submitted and bills the school for the application processing fees. |

Reducing and Waiving Fees

Liaison recognizes that some programs may want to reduce or waive fees for certain subsets of their applicant pool, such as alumni, in-state residents, military personnel, or special interest groups, to name a few. You can use one or a combination of the following methods to reduce or waive fees:

- Variable fees.

- Automatic fee waivers.

- Application coupons.

Setting up Variable Fees for Your Programs

In some cases, you might want to offer different fee amounts to subsets of your applicant pool. For example, you might want to lessen the application processing fee, the program fee, or both for applicants who are military dependents. To do so, you can configure a Change Fee question rule that changes the fee based on a question response.

Note: if you decide to lessen a program fee, Liaison’s application processing fee, or both, this will be reflected in the quarterly report Liaison provides for reconciliation and remittance. See the Reporting, Reconciliation, and Remittance section below for more information.

Setting Up Automatic Fee Waivers for Your Programs

In some cases, you might want to waive fees for certain subsets of your applicant pool. For example, you might want to waive the application processing fee, the program fee, or both for applicants who are alumni. To do so, you can configure a Fee Waiver Qualification question rule that waives the fee based on a question response.

Note: if you decide to waive a program fee, Liaison’s application processing fee, or both, this will be reflected in the quarterly report Liaison provides for reconciliation and remittance. See the Reporting, Reconciliation, and Remittance section below for more information.

Using Application Coupons

You can utilize application coupons via the following two methods. Contact a member of your account team for more information or to obtain coupon codes.

Fee Assistance Program

Your participation agreement may outline that each cycle, Liaison covers the application processing fee for a certain percentage of a school’s submitted applicants (this percentage is noted in your contract). These application processing fees are offset via coupons that you can provide to domestic applicants who demonstrate financial hardship. At the end of the cycle, Liaison performs a reconciliation, comparing the coupons redeemed to the applications received, applying the allotted percentage, and billing the school for any shortfall in applicant processing fees.

The following conditions apply to this program:

- Schools can request and issue coupons at any time throughout the cycle.

- At the end of the cycle, Liaison will perform a reconciliation and will apply the coupon value toward your account balance.

- If at the end of the cycle the total redeemed coupons amount equals more than the allotted financial hardship percentage, Liaison will invoice the school for the difference.

- If at the end of the cycle the total redeemed coupons amount equals less than the allotted financial hardship percentage, no credits will be issued and no remaining balances will be carried forward or applied in other cycles.

Schools that choose to use the fee assistance program benefit are encouraged to perform forecasting before the start of the cycle to estimate the amount of coupons to request.

For more information on utilizing this program, contact a member of your account team.

Purchasing Additional Coupons

In some cases, you might want to issue more coupons than what you are allotted via the Fee Assistance Program. If so, you can purchase application coupons directly from Liaison.

For more information on purchasing coupon codes, contact a member of your account team.

Note: schools can request coupon amounts in excess of the allotted Fee Assistance Program percentage but are responsible for funding any differences. If you decide to purchase coupons in excess of the allotted percentage, this will be reflected in the quarterly report Liaison provides for reconciliation and remittance. See the Reporting, Reconciliation, and Remittance section below for more information.

Reporting, Reconciliation, and Remittance

Setting Up Reconciliation

Once you go live, a member of your account team will work with you to identify the primary point(s) of contact to receive reports and manage your payments. To get set up for payments, the primary point of contact must:

- Complete a New CAS Customer Setup form.

- Email the completed form to billing@liaisonedu.com and include a completed Form W-9 and a tax exemption form, if applicable.

Reporting and Remittance Schedule

Quarterly reports are emailed to the primary point of contact according to the schedule below. Once the report is approved by the point of contact, Liaison will process any payments via check or ACH (depending on how the primary point of contact set up reconciliation). Payment-related questions can be sent to billing@liaisonedu.com.

|

Calendar Quarter Covered |

Quarter End Date |

Report Issued By |

Payment |

|---|---|---|---|

|

January 1–March 31 |

March 31 |

May 30 |

Payment initiated within 10 business days of receipt of approval from institution. |

|

April 1–June 30 |

June 30 |

August 29 |

Payment initiated within 10 business days of receipt of approval from institution. |

|

July 1–September 30 |

September 30 |

November 29 |

Payment initiated within 10 business days of receipt of approval from institution. |

|

October 1–December 31 |

December 31 |

February 28 |

Payment initiated within 10 business days of receipt of approval from institution. |

Overview of Quarterly Report

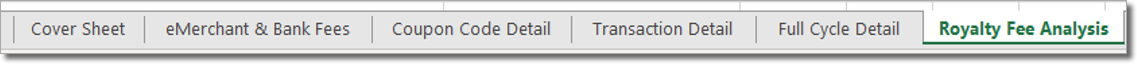

Quarterly reports are delivered as Excel workbooks that contain a series of worksheets, which are described below.

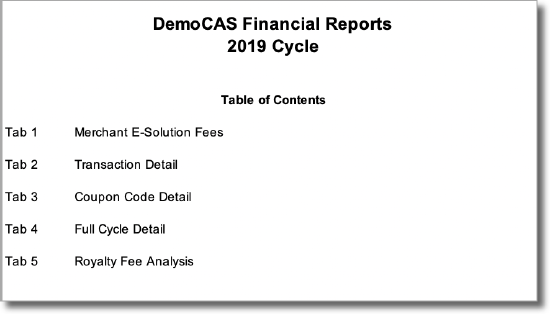

Cover Sheet

This tab is similar to a table of contents – it provides details on each of the tabs in the workbook.

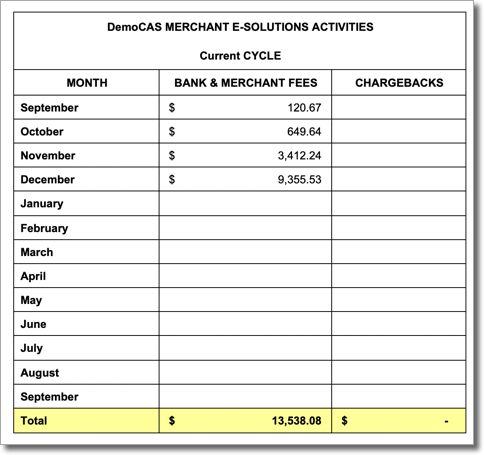

eMerchant & Bank Fees

This tab shows what the credit card and bank fees are for each month in the cycle.

Coupon Code Detail

This tab shows all the coupon codes that have been redeemed in the period covered by the report. There are 17 columns of data. The following columns are most pertinent to this report:

- Organization (Program): the institution name and the program at the institution for which the coupon code was redeemed.

- Applicant Name: the applicant's name.

- Email: the applicant's email address.

- Date Redeemed: the date the applicant redeemed the coupon.

- Coupon Amount: the value of the coupon.

- Coupon Type: there are three types of coupon codes:

- School Fee: this type of coupon covers the cost of the school's program fee. In the example above, the cost of the Fall 2020 Computer Science program is $65.

- Processing Fee: this type of coupon covers Liaison's application processing fee. In the example above, the fee is $58.

- Combined: this type of coupon code covers the total of the school's program fee and the Liaison application processing fee. In the example above, the combined fee is $123 ($65 program fee + $58 application processing fee).

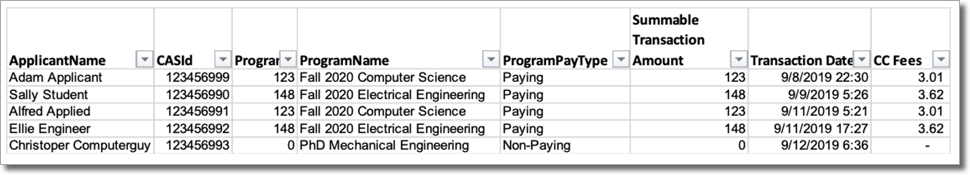

Transaction Detail

This tab provides detailed information for each applicant applying to the institution. There are 25 columns of data. The following columns are most pertinent to this report:

- Applicant Name: the applicant's name.

- CAS Id: the applicant's CAS ID number.

- Program Fee: the fee for the program the applicant is applying to.

- Program Name: the name of the program the applicant is applying to.

- Program Pay Type: indicates whether the program is a “Paying” or “Non-Paying” program. Institutions may not charge a fee for certain programs, as is the case for the PhD Mechanical Engineering in our example above. Note that while an institution may not charge a fee, Liaison’s processing fee still applies.

- Summable Transaction Amount: the amount Liaison collected from the applicant upon application submission (a negative number indicates a refund or chargeback).

- Transaction Date: the date the summable transaction amount was collected (i.e., the date the application was submitted).

- CC Fees: the credit card fee that was charged for the transaction.

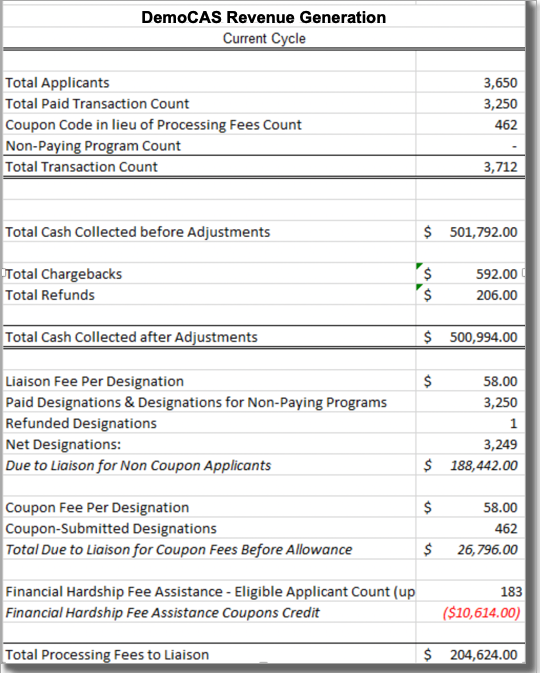

Full Cycle Detail

This tab uses the pertinent information from the Transaction Detail tab to calculate the amount owed for Liaison processing fees.

This tab is also where you can find the Fee Assistance Program calculation. In the example above:

- The institution had 3,650 total applicants.

- The application processing fee is $58.

- The institution's contract (not shown) indicates Liaison will cover processing fees for 5% of submitted applicants, which equals 183 applicants (3,650 applicants x 5% = 183).

- The institution received an allowance of $10,614 in coupon codes (183 applicants x $58 processing fee = $10,614).

Note that the report indicates that $26,796 worth of coupons were redeemed. Liaison applies the $10,614 fee assistance credit and the remaining amount of redeemed coupons is included in the balance due to Liaison (i.e., Total Processing Fees to Liaison).

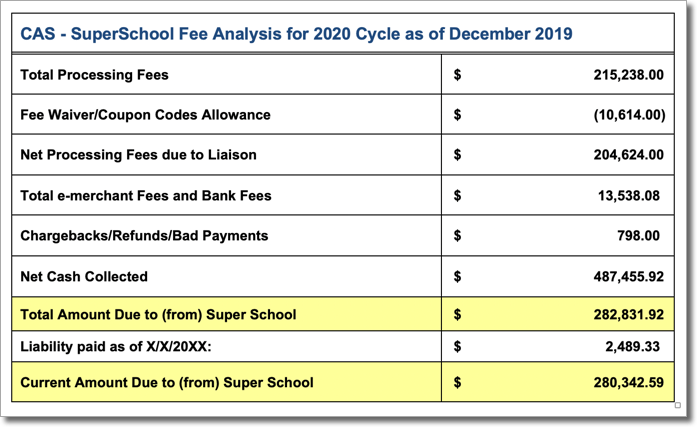

Royalty Fee Analysis

This tab displays a general breakdown of fees and the ultimate amount owed to or due from your institution.

Note that based on your institution's contract, your report may vary slightly from the example below.

- Report Header: this line displays which CAS the report represents and through which quarter-end the report runs.

- In this example, the report includes activity for SuperSchool for the 2019–2020 cycle through December 31, 2019.

- Total Processing Fees: the total fees owed to Liaison for application processing.

- This amount represents the number of processed applications multiplied by the fee Liaison charges for the service.

- Fee Waiver/Coupon Code Allowance: the total amount of coupons Liaison provides to the institution via the Fee Assistance Program (see above).

- The details for any redeemed coupon codes are provided in the Coupon Code Detail tab of the report (see above).

- Net Processing Fees due to Liaison: the Total Processing Fees less any Fee Waiver/Coupon Code Allowances.

- Total e-merchant Fees and Bank Fees: the total amount of credit card and bank fees charged for application payments. This amount is provided on an averaged basis across the CAS. For example, if Liaison pays a total of $14,000 in CAS credit card processing fees on $652,000 worth of CAS payments for the month of December, the averaged rate for that month will be 2.14% ($14,000/$652,000). The 2.14% will be applied to each payment received in that month and broken down by institution.

- Note that Liaison is charged approximately $20 for any disputes/chargebacks filed by applicants. These fees are not averaged across the CAS and are instead applied only to the institution to which the applicant’s original payment was made. Chargeback information appears in several places in the report:

- Chargeback details are displayed as line items on the Transaction Detail tab of the report.

- Chargeback fees are indicated in the eMerchant & Bank Fees tab of the report.

- Note that Liaison is charged approximately $20 for any disputes/chargebacks filed by applicants. These fees are not averaged across the CAS and are instead applied only to the institution to which the applicant’s original payment was made. Chargeback information appears in several places in the report:

- Chargebacks/Refunds/Bad Payments: the total amount of refunds and chargebacks processed cycle-to-date (fed from the eMerchant & Bank Fees tab of the report).

- Net Cash Collected: the total amount Liaison has collected on behalf of the institution, less the Chargeback/Refunds/Bad Payments.

- For the total amount collected, see the Transaction Detail tab or Full Cycle Detail tab of the report (see above).

- Total Amount Due to (from) Institution: the Net Processing Fees due to Liaison less Net Cash Collected.

- This is the amount Liaison owes the institution or the amount the institution owes Liaison (if negative).

- Liability paid as of X/XX/20XX: displays what Liaison has previously paid to the institution for this CAS in this cycle, if any.

- Current amount due to (from): the Total Amount Due to (from) Institution less any Liability paid as of X/XX/20XX.

- If the net amount collected is less than amounts owed to Liaison, this number represents monies owed to Liaison (negative amount).

- If the net amount collected exceeds any amounts owed to Liaison, this number represents the amount Liaison owes to the Institution (positive amount).

- Important: this is the final amount that the receiver of the report must confirm and approve to get the payment process initiated if monies are owed to the institution.